Lexus Ranks Highest among All Brands; Kia Ranks Highest among Mass Market Brands for Third Consecutive Year

The J.D. Power 2023 U.S. Vehicle Dependability StudySM (VDS), released today, reports an industry average of 186 problems per 100 (PP100) vehicles, an improvement of 6 PP100 from 2022. The study examines how 2020 model-year vehicles are currently performing in terms of quality, component replacement and appeal—including those vehicles with new technology—and helps automotive manufacturers design and build better vehicles to stand the test of time and promote higher resale value. A lower PP100 indicates higher performance.

Leading the industry’s improvement for fewer problems are mass market brands with 182 PP100, 8 PP100 lower than a year ago and 23 PP100 lower than for premium brands (205 PP100). The gap between the two segments is at its widest since the study launched 34 years ago and mirrors a trend that began in 2016. A driving force for the dependability disparity between the two segments is new technology introduced in vehicles. Premium brands usually have more technology, which increases complexity and the inherent likelihood of additional problems.

“It is typical in the automotive industry to roll out concepts and features by putting them in premium vehicles first,” said Frank Hanley, senior director of auto benchmarking at J.D. Power. “A bellwether for mass market brands looking to adopt and implement these technology features into their portfolio is in two of the industry’s preeminent studies, the J.D. Power Initial Quality StudySM (IQS) and the Vehicle Dependability Study. Connecting insights from the two studies better informs automakers by substantiating trends and showcasing how some automakers are preventing problems from occurring early on and throughout the ownership experience.”

The 3-year-old vehicles measured in this year’s study were first examined in the 2020 U.S. Initial Quality Study. Six of the 10 highest-ranked brands in the 2020 IQS are among the 10 highest-ranked brands in this year’s VDS. Some of the most deteriorated areas from 90 days to three years of ownership are starter battery failures, outdated maps, Android Auto/Apple Car Play and voice recognition problems. The increase in problems in the technology area shows the importance that over-the-air updates can play in correcting issues with audio systems and keeping the information in them up to date.

The study was redesigned in 2022 to include features and technology that are available in current vehicles. It now covers 184 specific problem areas across nine major vehicle categories: climate; driving assistance; driving experience; exterior; features/controls/displays; infotainment; interior; powertrain; and seats.

Following are key findings of the 2023 study:

- Infotainment systems continue to be most problematic: The infotainment category continues to be the most problematic with an average of 49.9 PP100—almost twice as many problems as the next-highest category, which is exterior. Six of the top 10 problem areas in the study are infotainment-related, including built-in voice recognition (7.2 PP100); Android Auto/Apple CarPlay connectivity (5.5 PP100); built-in Bluetooth system connectivity (4.0 PP100); touchscreen/display screen difficult to use (4.0 PP100); not enough power plugs/USB ports (3.8 PP100); and navigation system inaccurate/outdated map (3.3 PP100). “IQS and VDS data are telling us that if the Android Auto/Apple CarPlay connectivity trend continues, this area could take over the least-coveted top spot for problems in long-term durability,” Hanley said.

- Technology improves appeal for parts that seem outdated: Owners’ relationships with their vehicles goes beyond wear and tear on parts; it also includes their expectations of how up to date the technology remains over time. For example, satisfaction scores for vehicle condition improve when vehicles receive over-the-air software updates to infotainment systems that are perceived to not be meeting today’s standards.

- Reduction in component replacement: Nearly two-thirds (63%) of vehicles required fewer component replacements in the past 12 months (excluding wear items), including key fob/key fob battery; brake rotors; headlight components/bulbs; and other exterior lights/bulbs, than in the 2022 study.

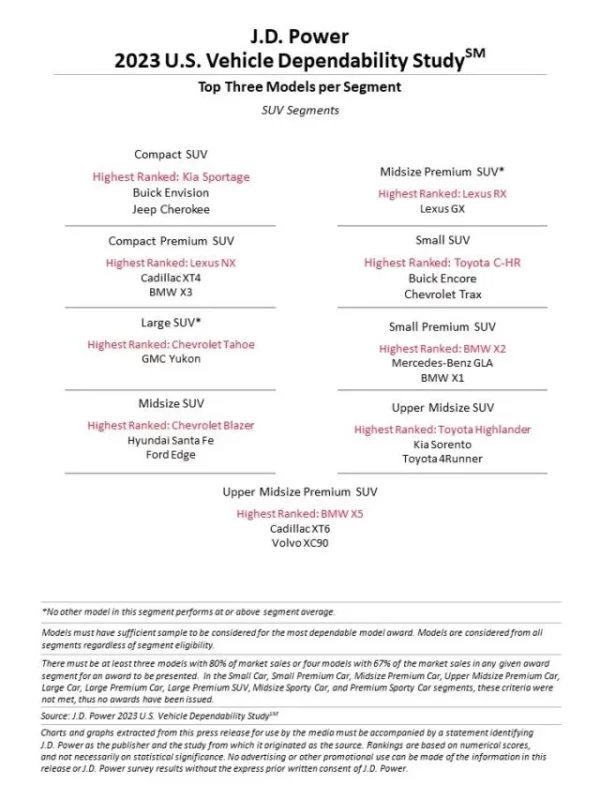

- Tie for the most dependable model: The Toyota C-HR and Lexus RX are the highest-ranked models in the study, each with 111 PP100. Both models show improvement in eight of the nine problem categories from a year ago.

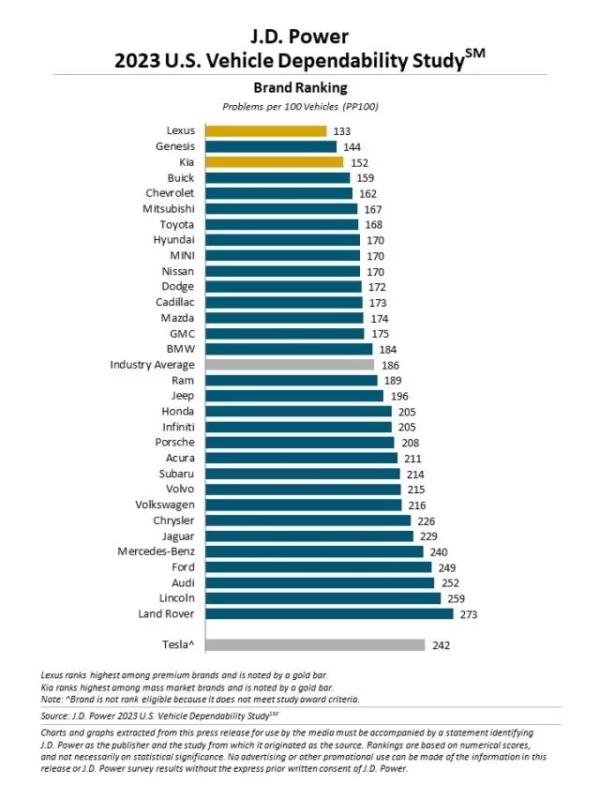

- Biggest problem solvers: The top three brands with the greatest improvement in the number of problems are Ram (77 PP100 improvement), Volvo (41 PP100 improvement) and Nissan (35 PP100 improvement).

- Tesla officially included for the first time: Tesla is included in the industry VDS calculation this year for the first time, with a score of 242 PP100. However, because Tesla does not allow J.D. Power access to owner information in the states where that permission is required by law, Tesla vehicles remain ineligible for awards.

Highest-Ranked Brands

Lexus ranks highest overall in vehicle dependability, with a score of 133 PP100. Other premium brands ranking high for vehicle dependability include Genesis (144 PP100), Cadillac (173 PP100) and BMW (184 PP100).

Kia (152 PP100) ranks highest in the mass market segment for a third consecutive year, followed by Buick (159 PP100), Chevrolet (162 PP100), Mitsubishi (167 PP100) and Toyota (168 PP100).

The parent corporation receiving the most model-level awards is Toyota Motor Corporation with six, which includes the Lexus NX, Lexus RX, Toyota C-HR, Toyota Highlander, Toyota Sienna and Toyota Tacoma. BMW AG and General Motors Company each receive four segment awards—BMW AG for the BMW 4 Series, BMW X2, BMW X5 and MINI Cooper, and General Motors Company for the Chevrolet Blazer, Chevrolet Silverado HD, Chevrolet Tahoe and GMC Sierra. Hyundai Motor Group receives three segment awards for the Kia Forte, Kia Optima and Kia Sportage.

J.D. Power analysis shows that vehicle residual values can be significantly affected by long-term quality.

“The used-vehicle market has helped sustain dealers’ profitability in the past couple of years, but they need to know which vehicles to have on their lots,” said Jonathan Banks, vice president and general manager of vehicle valuations at J.D. Power. “Having vehicles with strong dependability scores will nurture a positive brand perception and drive foot traffic.”

The 2023 U.S. Vehicle Dependability Study is based on responses from 30,062 original owners of 2020 model-year vehicles after three years of ownership. The study was fielded from August through November 2022.

Source: 2023 U.S. Vehicle Dependability Study(VDS) | J.D. Power (jdpower.com)